The State Oil Fund of the Republic of Azerbaijan (SOFAZ) regularly publishes quarterly and annual statements on revenues, expenditures, and assets. The statements are available to the public. What do they reveal about the Fund’s investments and management strategies?

About the Author: Gubad Ibadoghlu, Senior Policy Analyst for social and economic studies at Azerbaijan’s Economic Research Center, a Baku-based NGO that promotes economic development and good governance.

In this publication, I would like to draw your attention to two issues in SOFAZ’s 2018 report on revenues, expenditures, and assets; analyze the Fund’s performance, and compare it to other national funds.

Decrease in assets, decrease in revenues

First, analysis of the latest SOFAZ report shows that by January 1, 2019, the Fund assets had decreased from October 1, 2018. On October 1, 2018, SOFAZ assets equaled 38.988 billion USD, while on January 1, 2019, the assets decreased by 472.5 million USD and equaled 38.515 billion USD.

Second, according to the latest report of SOFAZ, on January 1, 2019, revenues from managing assets of SOFAZ drastically decreased in comparison with the situation on October 1, 2018. On October 1, 2018, profit from management of SOFAZ assets was 995.6 million AZN (585.6 million USD); by January 1, 2019, it decreased by 815.5 million AZN and equaled 181.1 million AZN (106.5 million USD).

Thus, in 2018 revenues from managing assets of SOFAZ assets decreased 6 times from 2017.

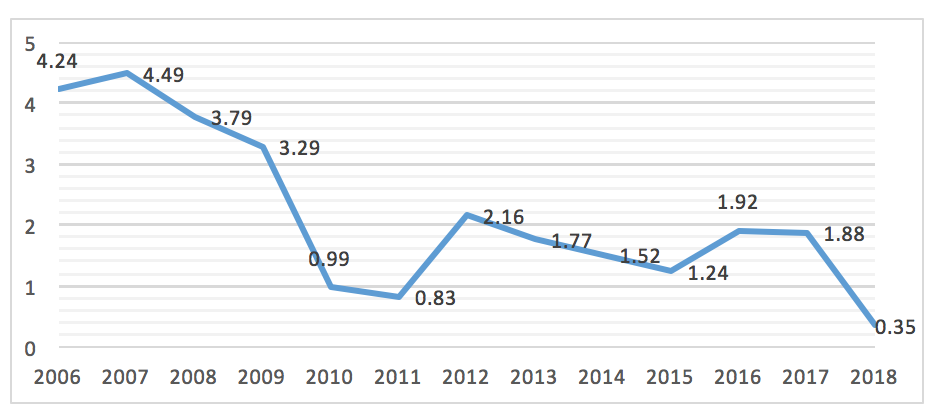

The Fund has been obtaining profit from the management of monetary assets since 2006. Let’s take a look at Graph 1 to observe changes in profits from the investment portfolio:

It is evident that the indicators of SOFAZ peaked in 2007 and were the lowest last year. The 2018 figure is even lower than it was after the 2009 global financial crisis.

What is in the portfolio?

The highest annual profit of 0.68% in the previous year was received from fixed income and money market instruments.

The annual profit from the investment portfolio placed in the real estate market was 0.54%. It is impossible to assess why the levels of revenues are low. Increase of investment to gold in the previous year has decreased efficiency of management of the investment portfolio.

One of the biggest contributors to SOFAZ’s losses in 2018 were equities. Comprising 12.8% of the Fund’s investment portfolio, they total 5 billion USD. In 2018, the Fund lost 42.9 million USD (-0.87%) in shares.

The Fund explained poor results in 2018 with an overall difficult year for the global stock market. The majority of economies demonstrated negative profits in the stock market against the background of weakening global economic growth in the last quarter of the year.

Factors such as tension due to Brexit, weakening of Chinese economic growth, increasing concerns in connection with the rate policy held by the US Federal Reserve System, along with pessimistic predictions regarding profits of companies against the background of increasing interest rates in the US, caused a negative impact on profits in the stock market.

Comparing SOFAZ to other national funds

It is noted in the statement that the global market trends negatively impacted other long-term institutional investors, such as some leading sovereign reserve funds.

For example, in 2018 the Norwegian sovereign State Pension Fund demonstrated -6.1% in profits, Alaskan and New Zealand sovereign funds had respectively -1.1% and -2.18% of profits in 2018.

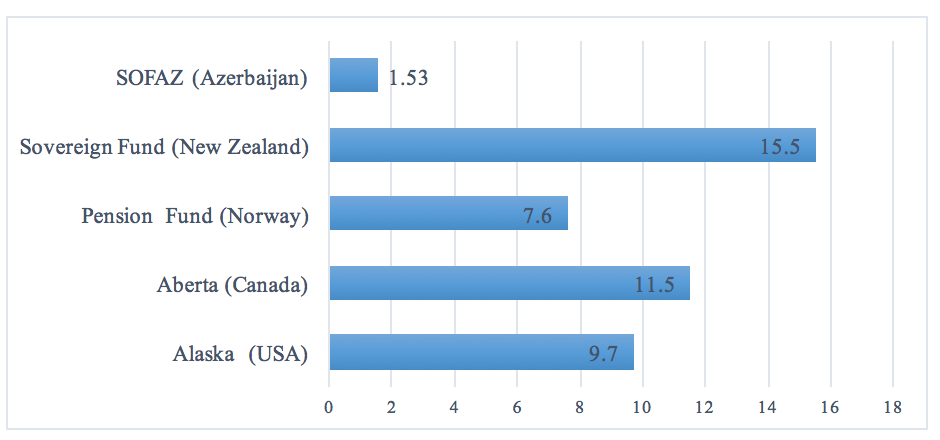

In the mentioned period the investment portfolio profits of the Oil Fund in local currency was 0.35%. SOFAZ’s results for that year look better in comparison, however, the average annual profits of investment portfolios of the Funds referred to by SOFAZ in 2010-2017 were significantly higher than SOFAZ’s. Let us take a look at Graph 2 to compare profits over a longer term:

The average annual profits of the investment portfolios in 2010-2017 equaled 7.6% for the Norwegian Pension Fund, 9.7% for the Alaskan Fund (USA), 11.5% for the Alberta Fund (Canada), and 15.5% for the New Zealand Sovereign Fund. The average annual profits of SOFAZ’s investment portfolio equaled 1.53% for the same period, 5 times less than the Norwegian Pension Fund, 6.3 times less than the US Alaskan Fund, 7.5 times less than the Canadian Alberta Fund, and 10 times less than the New Zealand Sovereign Fund.

Time delay

It is worth adding that the statements for 2018 and 2017 were published later compared to the recognized timeframe. According to the information policy of the Fund, one of the main duties of the Fund is revealing all information in a timely, correct, and precise manner and accessible to the public.

The statement about profits and expenditure of 2018 was published at the beginning of March this year. The statement for 2017 was published in February of 2018.

I raised this question and shared my concerns about the late publication of the annual statement with SOFAZ. SOFAZ responded, stating that SOFAZ’s assets were being audited at the end of every year. But since, as it was mentioned by the Fund itself, these activities take place every year, they cannot be seen as special reasons for the late publication.

Conclusions

The retrospective assessment of the SOFAZ performance in the previous year shows that delaying the publication of the annual statement on revenues, expenditures, and assets was related to failures in the SOFAZ investment strategy for 2018.

Also, SOFAZ makes it difficult to conduct a detailed analysis by limiting access to important information. Transparency of the Fund’s investment portfolio should increase, the source revenues should be revealed in more detail, and rent contracts of SOFAZ’s properties should be disclosed and published each financial year.

As SOFAZ celebrates its 20th anniversary this year, it should publish timely and detailed information on the management of assets in the investment portfolio. This information would help increase the awareness of ordinary Azerbaijani citizens about oil and gas revenues and assets management.