Jeffrey Dunn, Research Coordinator

Since the outbreak of Russia’s full-scale war of aggression against Ukraine, western governments and companies have taken steps to isolate Russia economically through sanctions targeting individuals, entities, and entire sectors of the economy.

All of this has been a part of a larger effort to suffocate the Russian war machine and encourage Russia to end its unjustified war. Yet, some well-known western energy companies aren’t interested in cutting their profits for the sake of peace in Ukraine. In today’s blog, we’ll be examining an instance of western companies sidestepping sanctions as they continue to profit from their engagement with Russia.

The Caspian Pipeline Consortium

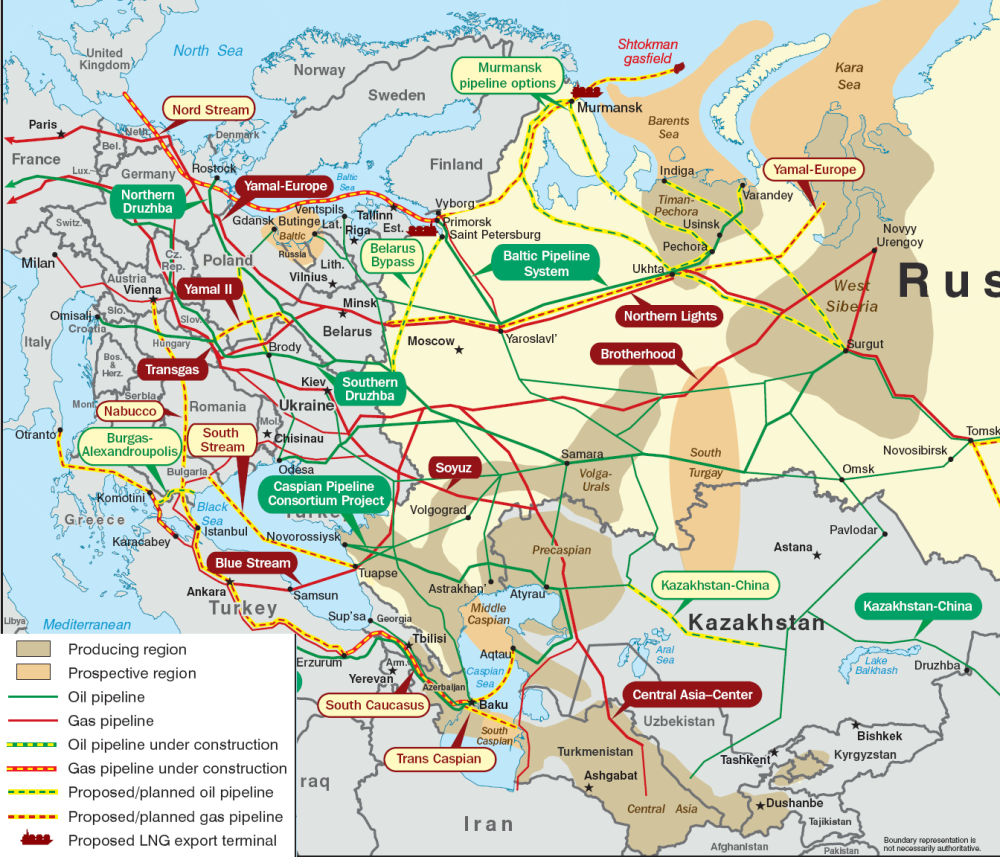

The Caspian Pipeline Consortium (CPC) is a group of energy companies that operate the Caspian pipeline, an oil pipeline and transport system that moves crude oil from the Kazakh oil fields of Tengiz, Kashagan, and Karachaganak to the Russian Black Sea port of Novorossiysk. From this port, the oil is exported to the international market.

While defenders of the CPC might suggest that this is the only existing avenue for the export of Kazakh oil to western markets, this explanation distorts the reality of the CPC and the oil that it transports.

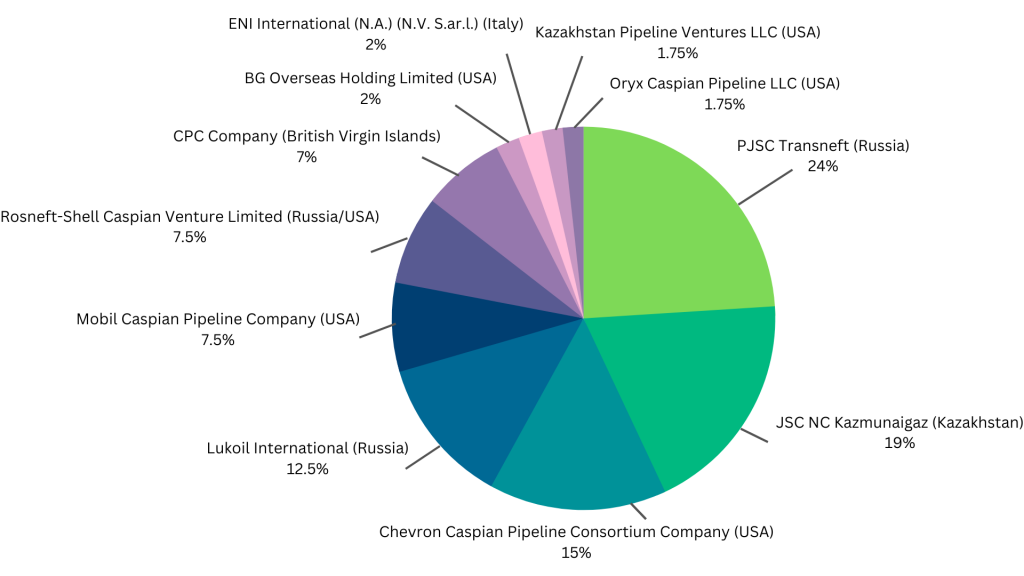

First, let’s examine the composition of companies in the CPC as well as the operators of the three Kazakhstani fields that supply the pipeline. According to the CPC website, the consortium is composed of 11 companies in total:

Russian companies own 36.5% of shares of the consortium, with an additional 3.825% partly held by Rosneft through Rosneft-Shell Caspian Venture Limited. Western companies hold approximately 31.93% of shares, with the remainder held by Kazakhstani or other ventures. A significant portion of the shares, and thus control, of the consortium, is held by Russian entities; entities that have been sanctioned. This in itself demonstrates a continued partnership between Chevron, Shell, ENI, and sanctioned Russian entities.

Let’s examine the claim that the CPC is simply transporting Kazakhstani oil. According to the Moscow Times,2 90% of the oil that flows through the Caspian pipeline is extracted from fields in Western Kazakhstan. These fields include Karachaganak, Kashagan, and Tengiz. According to the US Energy Information Administration,3 Russia provides the remaining 10%.

This makes sense when we consider the geographic position of the CPC pipeline, illustrated in the above two maps. The first map shows the route of the CPC pipeline, which starts in Western Kazakhstan, cuts through southern Russia, and ends at the CPC terminal in Novorossiysk. The second shows the same pipeline in connection to the rest of Russia’s infrastructure and Russia’s oil production regions.

Who operates the Karachaganak, Kashagan, and Tengiz fields?

Two of the three Kazakhstani fields that supply the CPC pipeline have Russian shareholders.

Karachaganak5

Operator: Karachaganak Petroleum Operating

Shareholders of the operating company

(29.25%) ENI (Italy)

(29.25%) Shell (UK)

(18%) Chevron (USA)

(13.5%) Lukoil (Russia)

(10%) Kazmunaigaz (Kazakhstan)

Kashagan oil field6

Operator: North Caspian Operating Company

Shareholders of the operating company

(16.81%) Eni (Italy)

(16.81%) ExxonMobil (USA)

(16.88%) Kazmunaigaz (Kazakhstan)

(16.81%) Shell (UK)

(16.81%) TotalEnergy (France)

(8.33%) CNPC (China)

(7.56%) Inpex (Japan)

Tengiz oil field7

Operator: Tengizchevroil8

Shareholders of the operating company

(50%) Chevron (USA)

(25%) ExxonMobil (USA)

(20%) Kazmunaigaz (Kazakhstan)

(5%) LukArco9 (Russia)

The oil flowing through the CPC is not just Kazakhstani in origin. Russian entities and international oil companies play a major role in the supply of oil throughout the entire CPC.

Karachaganak-Orenburg

Karachaganak also supplies the Gazprom gas refinery in Orenburg Russia with gas condensate via the Karachaganak-Orenberg transportation system.10 In 2020, the field sold 8,986 million standard cubic meters of gas to the Gazprom refinery, accounting for over 44% of total gas production.11

Corporate Response

Chevron, Shell, Exxonmobil, and ENI represent four of the largest energy companies in the world. In correspondence with Crude Accountability, Shell stated, “Shell shares your deep concern regarding the tragic events in Ukraine and the need to take actions that put pressure on the Russian authorities. As a result, we have taken decisions to withdraw from our Russian businesses and have already achieved some significant milestones.” This was followed by a link to Shell’s media page, providing a few media statements on the company’s intent to leave Russia, the sale of Shell Neft LLC, and the intent to leave joint ventures with Gazprom. However, Shell also stated, “Shell has no current intention to exit the CPC, which plays a vital role in transporting Kazakh oil to many countries, especially in Europe.” Crude Accountability also wrote to Chevron, ENI, and Exxon about their involvement with Russian corporate entities and received no response.12

Shell is the only western company involved in the CPC that has provided any indications of its approach to the war, its intent to leave Russia, and a consolidated section of its online site that houses these updates.13 ENI announced a fundraiser for Ukraine in March 2022.14 ExxonMobil and Chevron have no mention of the conflict on their sites, and no consolidated section of media releases that express their response.

Conclusion

Despite efforts of western governments and companies to sanction the Russian energy sector and associated entities, and the majority of western public opinion supporting the isolation of Russia from the global economy because of the invasion of Ukraine, Chevron, Shell, ExxonMobil, and ENI continue to invest in the CPC. Russian oil flows through the pipeline to the global market. Gas condensate from the Karachaganak field flows to the Orenburg refinery, owned by Gazprom. These companies and sanctioned entities continue to profit while the war in Ukraine continues and the Russian economy benefits from oil exports, which comprised 45% of the economy in 2021.15 When will we hold them accountable?

1https://www.cpc.ru/EN/about/Pages/maps.aspx (top map)

2https://www.themoscowtimes.com/2022/07/06/russian-court-suspends-kazakh-oil-pipelines-operations-a78221

3https://www.eia.gov/todayinenergy/detail.php?id=51838

4https://www.resilience.org/stories/2014-07-31/the-ukraine-conflict-peak-cheap-gas-and-the-mh17-tragedy/

5https://www.kpo.kz/en/about-kpo/parent-companies

6https://media.business-humanrights.org/media/documents/North_Caspian_Operating_Company.pdf

7https://www.hydrocarbons-technology.com/projects/tengiz/

8https://www.chevron.com/projects/tengiz-expansion

9LukArco is a subsidiary of Lukoil, which owns 100% shares.

10https://www.nsenergybusiness.com/projects/karachaganak-oil-and-gas-condensate-field/

See also: https://www.reuters.com/article/russia-kazakhstan-gas/gazprom-risks-loss-of-karachaganak-gas-sources-idUSL6E7NS0U220111228

11https://www.kpo.kz/docs/sustainable_development_report/en/004-proizvodstvo_proekty_razvitiya.php

12https://crudeaccountability.org/letter-to-chevron-in-response-to-the-russian-invasion-of-ukraine/

13https://www.shell.com/war-in-ukraine-shell-response.html

14https://www.eni.com/en-IT/media/news/2022/03/ukrainian-fundraising-initiative.html

15https://www.iea.org/countries/russia